IBM earnings show solid growth but stock slides anyway

[ad_1]

IBM Corp. conquer second-quarter earnings estimates nowadays, but shareholders have been unimpressed, sending the computing giant’s shares down additional than 4% in early after-several hours investing.

Revenue rose 16%, to $15.54 billion in continual currency terms, and rose 9% from the $14.22 billion IBM documented in the very same quarter a year ago right after altering for the spinoff of managed infrastructure-company business Kyndryl Holdings Inc. Net money jumped 45% 12 months-over-12 months, to $2.5 billion, and diluted earnings for each share of $2.31 a share were up 43% from a 12 months back.

Analysts had anticipated modified earnings of $2.26 a share on earnings of $15.08 billion.

The solid numbers weren’t a shock offered that IBM experienced guided anticipations towards substantial single-digit expansion, and there was no very clear purpose why the stock declined. The selloff may have been in response to marginally smaller sized gross earnings margins in the software, consulting and infrastructure enterprises in the quarter. Free hard cash circulation was also down marginally this quarter as opposed to a year back, despite the fact that up substantially for the initial six months of the calendar year.

It is also feasible that a report saying Apple was searching at slowing down using the services of, which prompted the in general marketplace to drop somewhat right now, may possibly have spilled above to other tech shares these kinds of as IBM in the extended buying and selling session.

Delivered on promises

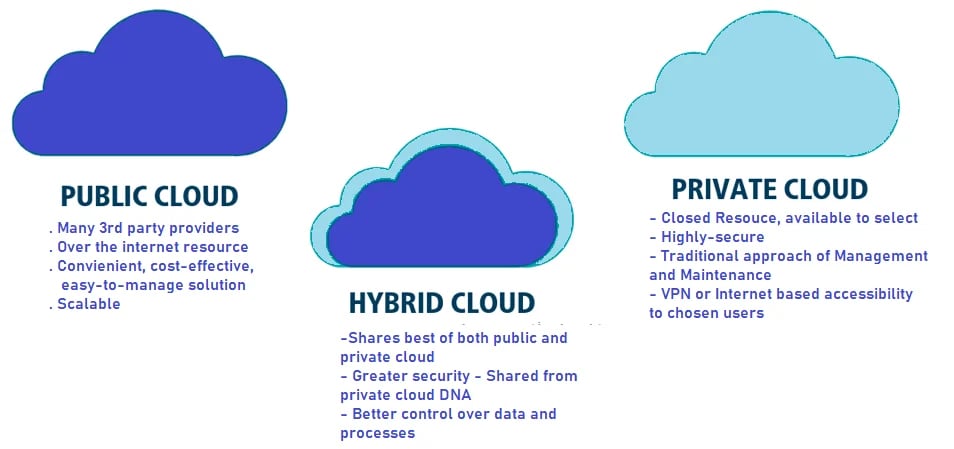

On the entire, the firm shipped what it mentioned it would. Its hybrid system and answers class grew 9% on the back again of 17% development in its Red Hat Company. Hybrid cloud income rose 19%, to $21.7 billion. Transaction processing gross sales rose 19% and the application segment of hybrid cloud earnings grew 18%.

Computer software profits grew 11.6% in continual forex terms, to $6.2 billion, assisted by a 7% bounce in sales to Kyndryl. Consulting earnings rose almost 18% in regular forex, to $4.8 billion, when infrastructure profits grew much more than 25%, to $4.2 billion, driven largely by the announcement of a new collection of IBM z Devices mainframes, which shipped 69% income development.

With traders on edge about the possibility of recession and his prospective influence on technologies paying out, Chief Government Arvind Krishna (pictured) shipped an upbeat concept. “There’s each and every cause to feel technology spending in the [business-to-business] market place will go on to surpass GDP advancement,” he mentioned. “Demand for methods continues to be potent. We carry on to have double-digit expansion in IBM consulting, wide advancement in software package and, with the z16 start, strong progress in infrastructure.”

Nutritious pipeline

Krishna called IBM’s existing revenue pipeline “pretty nutritious. The 2nd fifty percent at this issue appears to be regular with the initial 50 % by products line and geography,” he claimed. He proposed that engineering expending is benefiting from its leverage at lowering costs, earning the sector much less susceptible to recession. ”We see the know-how as deflationary,” he said. “It acts as a counterbalance to all of the inflation and labor demographics folks are dealing with all more than the globe.”

With IBM currently being the very first significant info technological know-how provider to report outcomes, Pund-IT Inc. Chief Analyst Charles King reported the numbers bode perfectly for stories soon to appear from other companies. “The energy of IBM’s quarter could portend good news for other vendors centered on enterprises,” he mentioned. “While those people businesses aren’t immune to systemic troubles, they have enough heft and buoyancy to ride out storms.”

One particular location that IBM has talked less and much less about over the previous few quarters is its community cloud business. The enterprise no for a longer time breaks out cloud revenues and prefers to speak as an alternative about its hybrid business enterprise and partnerships with significant general public cloud companies.

Hybrid concentration

“IBM’s key concentrate has extended been on establishing and enabling hybrid cloud offerings and solutions that’s what its enterprise customers want, and that’s what IBM’s methods and consultants aim to deliver,” King stated.

Krishna asserted that, now that the Kyndryl spinoff is full, IBM is in a potent posture to keep on on its prepare to produce significant-one-digit revenue development percentages for the foreseeable foreseeable future. Its consulting organization is now focused principally on organization transformation initiatives fairly than know-how implementation and the people today-intense business sent a pretax profit margin of 9%, up 1% from last yr. “Consulting is a significant component of our hybrid system thesis,” explained Chief Economical Officer James Kavanaugh.

Pund-It’s King stated IBM Consulting “is firing on all cylinders. That involves double-digit expansion in its a few major classes of small business transformation, technological know-how consulting and software functions as properly as a notable 32% expansion in hybrid cloud consulting.”

Greenback anxieties

With the U.S. dollar at a 20-yr high against the euro and a 25-year significant in opposition to the yen, analysts on the company’s earnings get in touch with directed various thoughts to the impression of forex fluctuations on IBM’s benefits.

Kavanaugh explained these are unknown waters but the firm is ready. “The velocity of the [dollar’s] strengthening is the sharpest we’ve seen in more than a decade more than half of currencies are down-double digits from the U.S. greenback,” he said. “This is unprecedented in price, breadth and magnitude.”

Kavanaugh said IBM is a lot more insulated from forex fluctuations than most firms for the reason that it has lengthy hedged in opposition to volatility. “Hedging mitigates volatility in the near time period,” he reported. “It does not get rid of currency as a issue but it will allow you time to address your organization design for value, for supply, for labor swimming pools and for cost structures.”

The company’s folks-intensive consulting business also has some designed-in protections against a downturn, Kavanaugh mentioned. “In a company in which you employ the service of tens of hundreds of people, you also churn tens of thousands every year,” he stated. “It gives you an automatic way to strike a pause in some of the profit controls simply because if you really don’t see desire you can sluggish down your supply-side. You can get a 10% to 20% impact that you pretty swiftly handle.”

Photograph: SiliconANGLE

Exhibit your assist for our mission by becoming a member of our Dice Club and Dice Function Community of authorities. Be a part of the group that features Amazon Web Providers and Amazon.com CEO Andy Jassy, Dell Systems founder and CEO Michael Dell, Intel CEO Pat Gelsinger and a lot of more luminaries and professionals.

[ad_2]

Resource url