Apple will soon offer “high-yield” savings accounts for its Apple Cash rewards

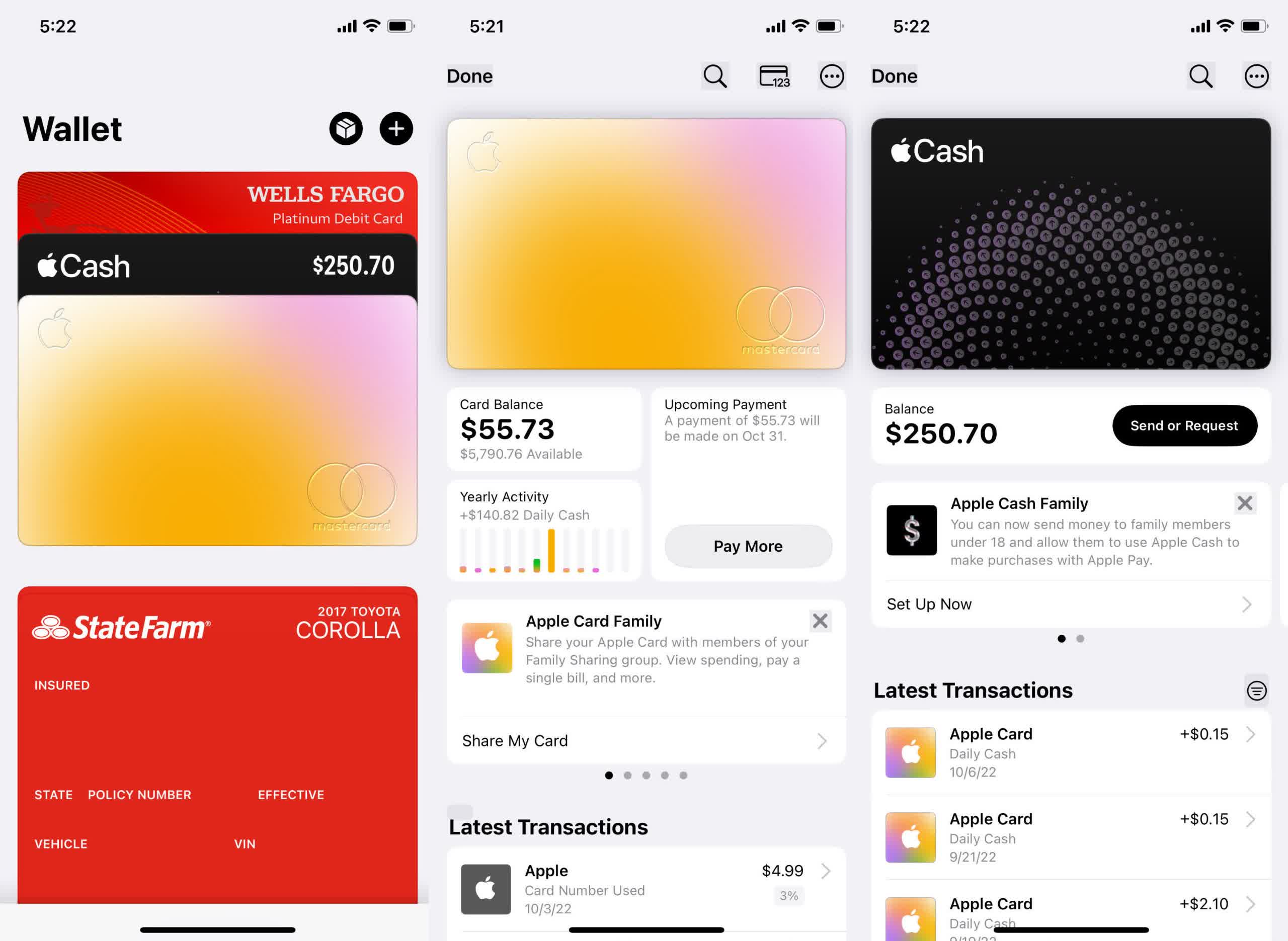

The large photo: In case you were not shelling out consideration, Apple is now a bank. I jest, but only a little. It began with the Apple Card, and now the tech giant needs to maintain your funds, as well. Of program, it is completely optional, but it does have some pros if you are presently an Apple cardholder.

As of Might 2021, there had been 6.4 million Apple Card users. Backed by Goldman Sachs, the overall services is well-known for its convenient features, such as Apple Spend and wallet app integration, genuine-time balances, on-device account management, income again, and protected card/CVV quantities.

Apple Card has been prosperous adequate that Cupertino now wants to maintain your savings. On Thursday, the organization declared it would before long present “large-produce” personal savings to Apple Cardholders.

“Apple declared a new Cost savings account for Apple Card that will allow end users to preserve their Day-to-day Money and mature their benefits in a higher-yield Savings account from Goldman Sachs,” Cupertino mentioned.

This is how it will work. Apple Card is by now set up to give people a few % again on Apple buys (in-retail outlet or electronic) and two percent for transactions with collaborating sellers like Walgreens, ExxonMobil, T-Cellular, and other people. All other costs get a 1-per cent return.

At present, this cash is saved on a individual digital card in Apple iphone owners’ wallets known as “Apple Dollars.” It functions like a pre-compensated debit card drawing from the Apple Money equilibrium. Consumers can also transfer resources to their normal lender account. In other phrases, the cash sits there till they do a thing with it.

Apple is proposing to place that money into a significant-yield Goldman Sachs personal savings so that it can make even more. As soon as buyers set up an account, Everyday Cash will automatically start depositing into the financial savings rather of Apple Money. Nevertheless, shoppers can even now choose to have the cash go into the virtual card if they like.

“End users can modify their Daily Income vacation spot at any time,” the push launch stated.

Apple failed to determine “higher yield,” but something is improved than practically nothing, which is what most banking companies give patrons on price savings accounts. The aspect could possibly be one more engaging perk for Apple Card buyers if it truly is definitely large-yield, especially taking into consideration the few banks that nonetheless provide interest-baring accounts commonly present considerably significantly less than one %.

Like all cards saved in the Wallet app, the discounts account will have a management monitor with related alternatives like viewing benefits and other routines. People can also transfer money to and from their connected examining accounts (applied for creating Apple Card payments), earning it like a common income deposit account, just without having the brick-and-mortar financial institution.

Escalating the progress prospective of Every day Money is a awesome small incentive to established apart a minor “absolutely free revenue,” primarily for those that hardly ever touch it in any case. It could occur in helpful for unexpected expenses or occasional splurging. If it truly is substantial-generate, it may well even be a much better alternative than users’ existing personal savings accounts. Regardless, it is challenging to imagine latest cardholders saying “no many thanks” to more revenue, irrespective of the produce.